Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam 1800 888 855 Aduan Penyeludupan 03-8882 21002300 Ibu Pejabat. The Sales and Services Tax SST has been implemented in Malaysia.

Mcdonald S The Local Flavours 12 July 2018 Mcdonald New Singapore S Favourite Local Dishes Inspired Flavours Ha Ha Cheong Gai Ch Chicken Burgers Flavors Burger

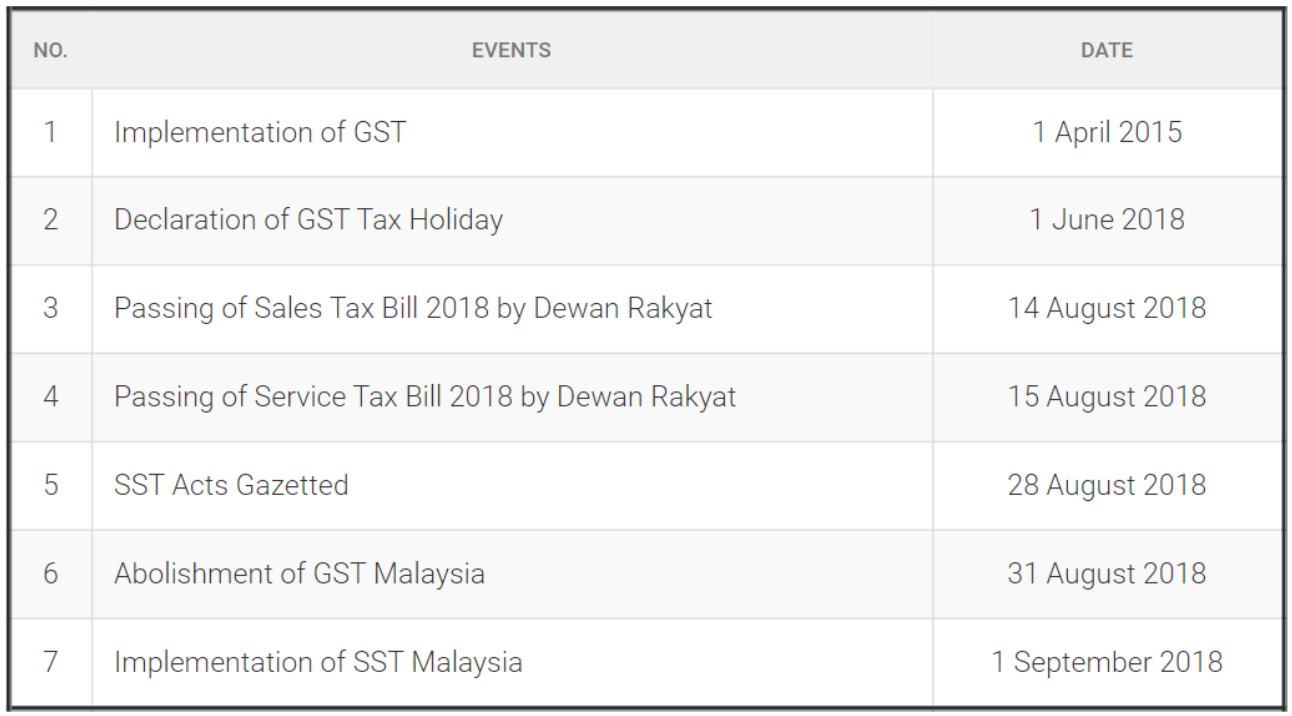

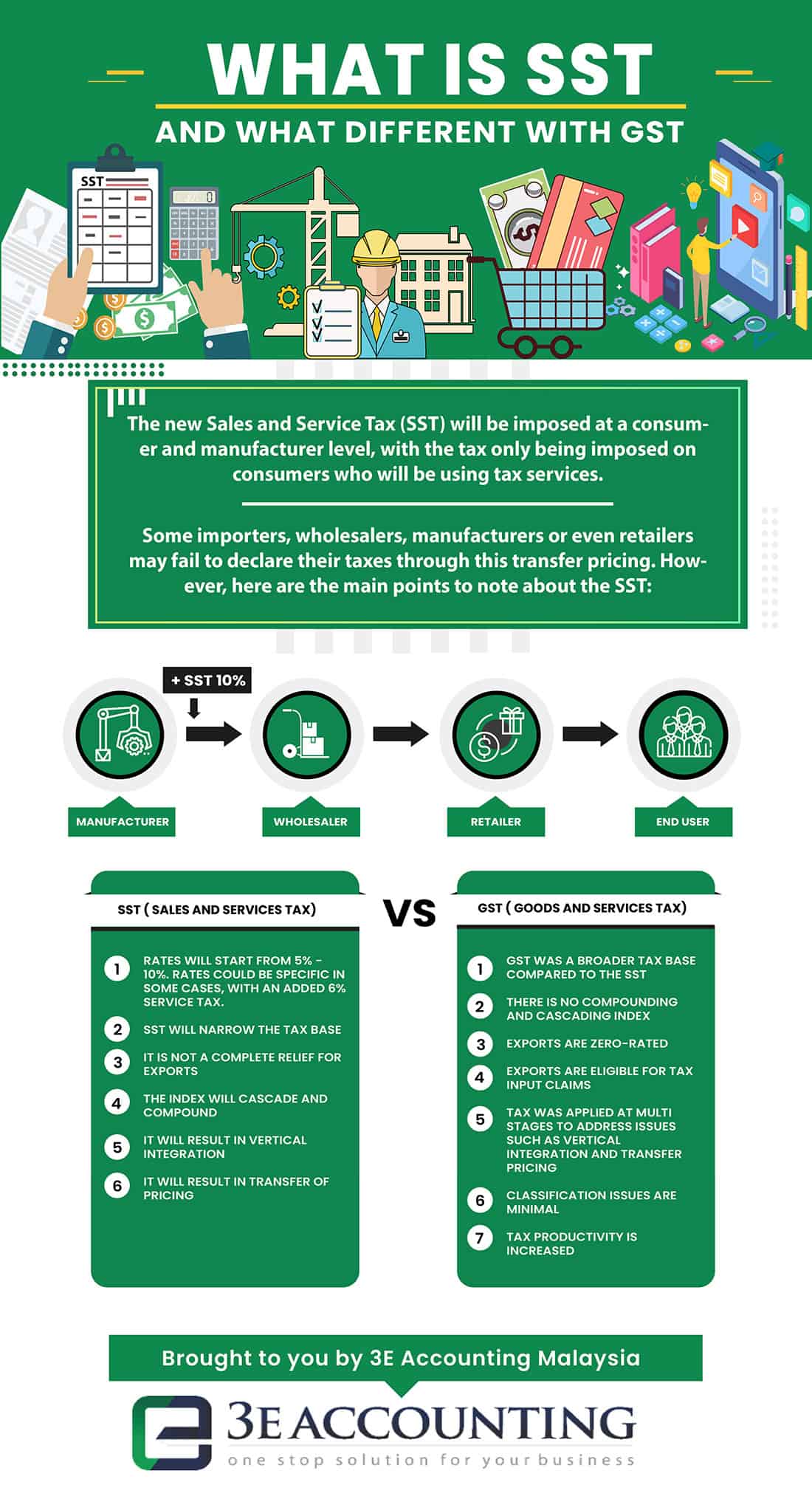

Implemented since September 2018 Sales and Service Tax SST has replaced Goods and Services Tax GST in MalaysiaThe SST consists of 2 elements.

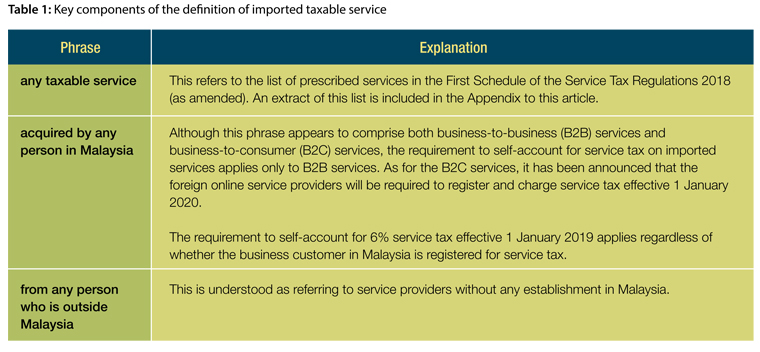

. All import shipments with customs clearance dated on or after September 1 2018 are now subject. Service tax in Malaysia is a form of indirect single stage tax imposed on specified services termed as taxable services. Effective 1 September 2018 the Malaysian Government has replaced the Goods and Services Tax GST with Sales and Service Tax SST.

2018 were subject to GST. 2 Overpaid or erroneously paid. Service tax a consumption tax levied and.

Sales tax a single-stage tax imposed on taxable goods manufactured locally and sold by a registered manufacturer and on taxable goods imported into Malaysia. GST was rated at 0 up to August 31 2018. Operating in Malaysia more than a year.

Click to enlarge. The revision sees a price hike for a number of models from as low as RM1000 for the GLC 200 to RM33000 for the AMG E 63 S 4Matic. The SST replaces the existing Goods and Services Tax GST and affects all domestic and import shipments.

It was announced on September 1st 2018 that the Sales and Services Tax SST will be reinstated to replace the controversial Goods and Services Tax GST system GST. Declare in Column 13 b 16 In prescribed form JKDM No. Section 61A STA 2018.

Sales Tax Act and Service Tax Act. Service tax cannot be levied on any service which is not included in the list of taxable services prescribed by the Minister under First Schedule of the Service Tax Regulations 2018. Entitle under subsection 356 or 413.

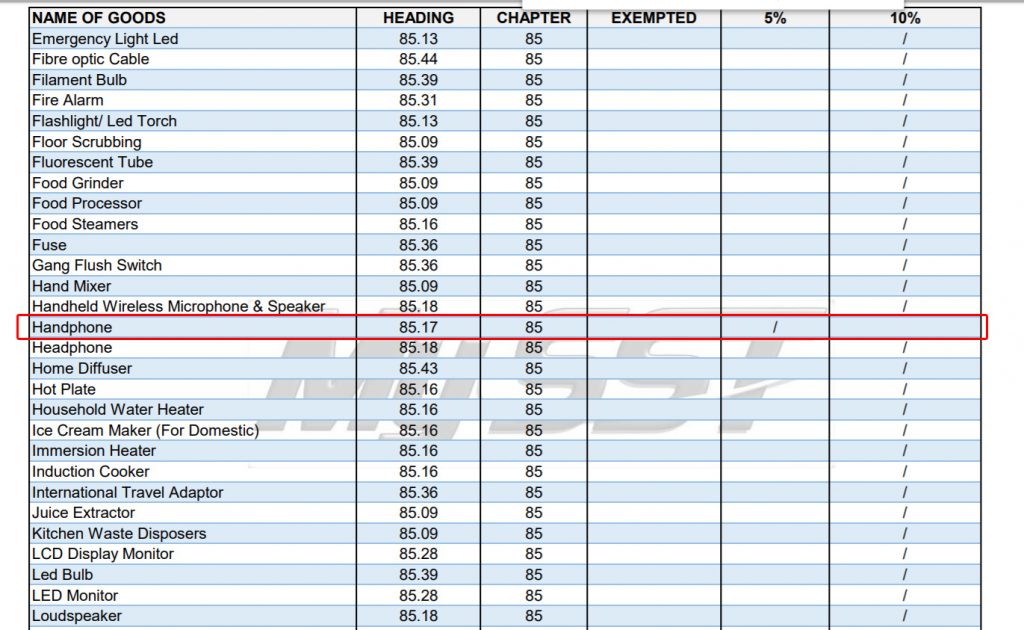

This will be the SST rate that will be implemented from 1st September 2018. Rather curiously the X5 xDrive40e M Sport sees a slight price increase with the introduction of SST now priced at RM390888 which is RM2000 more than when with GST. Sales and Service Tax SST has replaced the Goods and Sales Tax GST on 1st September 2018 in Malaysia.

On the National Tax Conference held on 17th July 2018 Malaysias Finance Minster Lim Guan Eng stated that the government will incur a 10 tax on sales of goods and 6 tax on service provision. The sales tax is based on exclusion criteria where all things are taxed by default unless being exempted whereas the service tax is based on inclusion criteria meaning. Service Tax Order 2018 SCOPE OF TAX 3.

SST consist of 2 separate act. Goods are subject to a 5 to 10 sales tax while services are subject to. In this regard Bursa Malaysia Berhad and some of its subsidiaries have been registered for service tax purposes and will start charging 6 service tax on certain fees effective from 1 May 2019.

The Sst Is Back Here S What You Need To Know Nocturnal

Malaysia Sst Sales And Service Tax A Complete Guide

Sales And Service Tax Act 2018

Sst For Handphones Revealed At 5 While Electronics Go For 10 For Slight Price Increase After 1 September 2018 Technave

![]()

Mercedes Benz Malaysia Announces New Sst Price List While Glc Gets Safety Updates

The Sst Is Back Here S What You Need To Know Nocturnal

Procuring Service From Foreign Providers Here S An Additional 6 Tax Accountants Today Malaysian Institute Of Accountants Mia

Motoring Malaysia Sst Prices For Bmw Cars Motorrad Mini In Malaysia Have Been Released Ckd Prices Mostly Goes Down With Cbu Prices Mostly Up

Sst Mazda 2018 Price List Paul Tan S Automotive News

Goods And Person Exempted From Sales Tax Sst Malaysia

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Sales And Service Tax Act 2018